|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

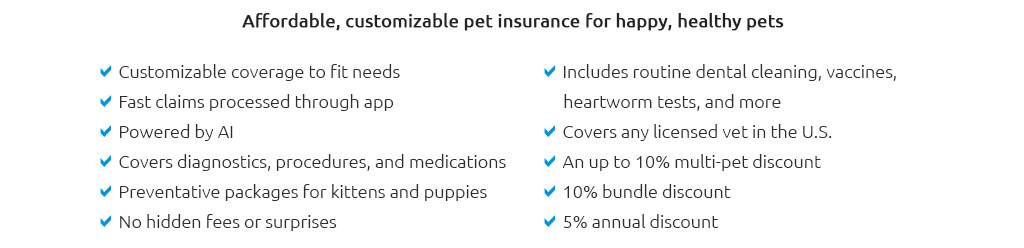

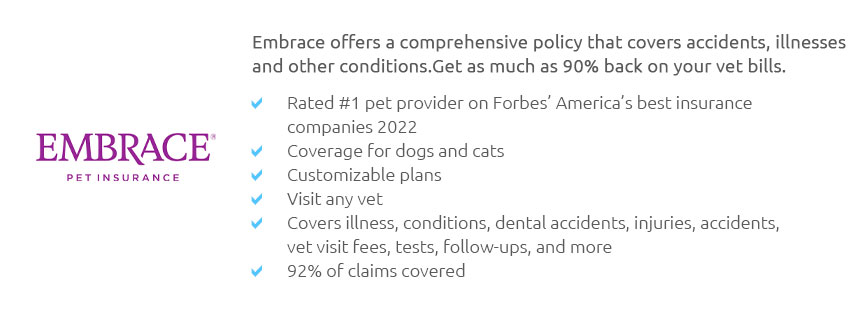

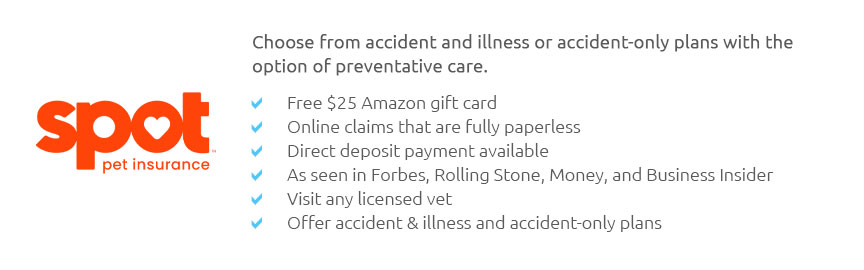

Comparing Dog Insurance: Making Informed DecisionsIn today's world, where our furry companions are more like family than mere pets, the importance of safeguarding their health cannot be overstated. Dog insurance is a topic that has gained significant traction, primarily because it offers a safety net against unforeseen medical expenses. But how does one navigate the myriad options available and make a choice that's both economically viable and beneficial for your pet? The task may seem daunting, yet with a bit of guidance, it becomes manageable. When embarking on the journey to compare dog insurance, the first step is understanding the different types of coverage available. Typically, policies range from accident-only plans to comprehensive ones that cover everything from illnesses to routine check-ups. Each has its own set of pros and cons, and the right choice largely depends on your pet's specific needs and your financial situation. Accident-only plans might be suitable for younger, healthy dogs, while a more inclusive policy could be indispensable for breeds prone to certain health issues. Another critical factor to consider is the cost of the insurance. Premiums can vary widely based on factors such as the dog's breed, age, and even your location. While it might be tempting to opt for the cheapest option available, it's crucial to weigh the cost against the benefits offered. A plan with a lower premium may have high deductibles or limited coverage, which could lead to higher out-of-pocket expenses in the long run. It's often worthwhile to pay a slightly higher premium for a plan that offers comprehensive coverage, ensuring peace of mind in case of unexpected events. The reputation of the insurance provider should not be overlooked. Researching customer reviews and ratings can provide valuable insights into the company's reliability and customer service quality. An insurer with a reputation for easy claims processing and responsive customer service can make a significant difference during stressful times.

Additionally, pay attention to the fine print in the insurance policy. Exclusions and limitations are common, and understanding these can prevent unpleasant surprises. Some policies might exclude coverage for pre-existing conditions, hereditary disorders, or even certain breeds. Knowing these details beforehand allows for a more accurate comparison between different providers. In conclusion, while the process of comparing dog insurance requires a careful and considered approach, the ultimate goal is to ensure your beloved pet receives the care they deserve without causing financial strain. Taking the time to analyze your options based on coverage, cost, provider reputation, and policy specifics will lead to a more informed decision. Investing in the right insurance plan not only protects your pet but also provides you with peace of mind, knowing that you're prepared for whatever the future may hold. https://thepetdoctorinc.com/wp-content/uploads/2019/04/veterinary-pet-insurance-comparison-chart-printable.pdf

What makes a pet insurance plan great? We asked the companies that questionthen asked the whole field. Comparing pet insurance for you, your veterinary team or ... https://www.comparethemarket.com/pet-insurance/

At Compare the Market, we only compare prices for pet insurance that covers dogs and cats, including puppies and kittens. https://www.petinsurancereview.com/dog-insurance

The following rankings are based entirely on the experiences of real pet parents just like you. Use our handy comparison chart to find the best dog insurance ...

|